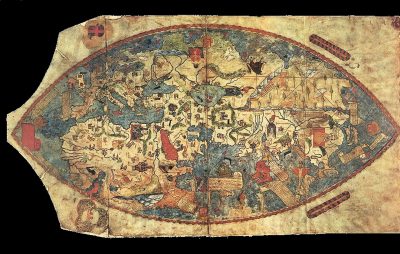

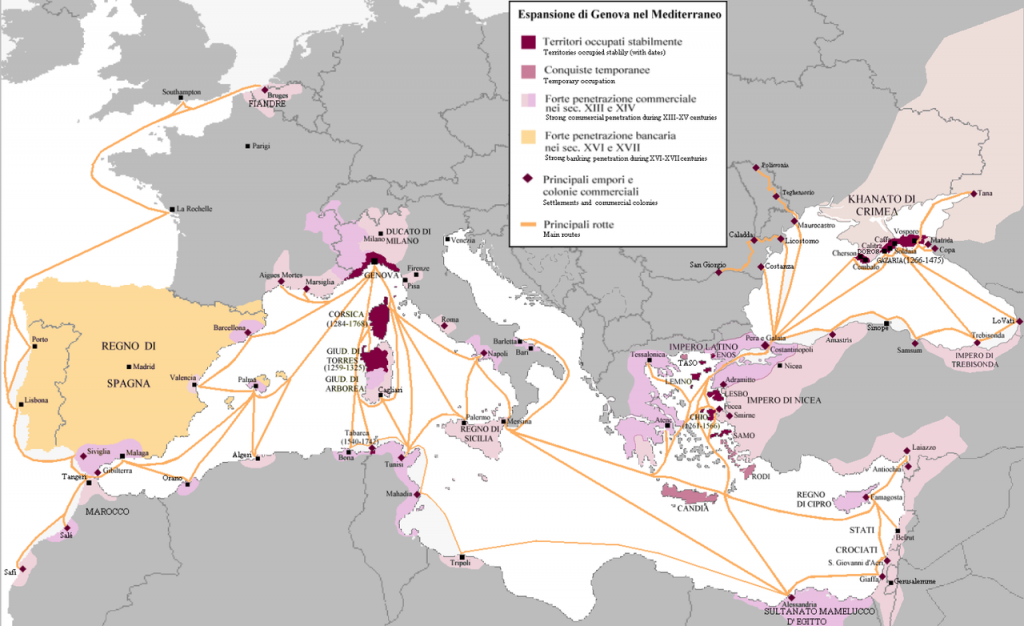

16th-century Genoa was in an odd spot. The previous two centuries (part 1 on Genoa is here) had been a series of disasters for the interests of the trading republic. The splintering of the Mongol empire made overland routes from the Far East hazardous, reducing the flow of merchandise to the eastern Mediterranean. The Ottoman conquest of Constantinople in 1453—and much of the eastern Mediterranean in the following century—cut Genoa off from her colonies and ports in the Black Sea and Levant. Portuguese incursions into the Indian Ocean broke the monopoly that Mediterranean merchants held on trade with the East.

And yet the republic thrived. Not only was it richer than ever before, but trade volume was the highest in its history. Economic expansion in Europe had created new demand for products from abroad; the flood of gold from the New World allowed historically cash-poor Europeans to pay for products from the East. Reduced though the Genoese share of trade was, the increase in total commerce was more than enough to compensate them.

But by this time, Genoa had another advantage working for her: well-oiled financial machinery. The enormous costs of shipbuilding required the extension of loans. The city had enough wealthy men to provide credit, but it was issued ad hoc. Over time, creditors organized and consolidated these loans into one of the first modern financial houses: the Casa di San Giorgio.

It was thus that the Republic of Genoa entered the world of finance.

Early Origins of the Casa di San Giorgio

By the 12th century, Genoa had found itself supporting crusading wars both in the Holy Land and on the Iberian Peninsula, furnishing ships and fighting men to support the local Christian princes. These were lucrative ventures—the Genoese were allowed a trading colony in each city they helped capture—but there was never enough cash on hand to outfit expeditions from the public treasury alone.

Trade by sea has always posed the problem of large upfront costs. Ships are expensive, and there is a long period before the first return on investment—provided the ship even survives the journey. And so commercial finance—like insurance, joint-stock corporations, and other defining features of the modern world—was invented to deal with this exact problem.

In Genoa, this began with a series of public debts that birthed the distinctively Genoese innovation of the Casa di San Giorgio—the Bank of Saint George. The bank was officially founded in 1407, although that date was the formalization of an institution that had coalesced over centuries. Its origins lay with wealthy merchants pooling great sums of money to loan to the government for outfitting expeditions.

In order to skirt the Church’s usury laws, investors would be granted the right to collect some portion of state revenues for the period of the loan. These revenues were usually import duties on certain commodities, which brought in a fairly predictable income. Practically, if not technically, this equated to receiving an interest rate equal to the annual revenue divided by the principal of the loan.

Evolution of the Bank

The loans collected from the wealthiest citizens of Genoa were not always sufficient for the purposes of the government. In such cases, it was necessary to open up the investment to the general public. Representatives of the government would hawk shares on the street, offering a proportional shares in the revenues being offered as security.

By degrees, this system of raising capital was formalized and institutionalized, coming to resemble what we would recognize as a modern bank. First, a number of administrators were appointed by the city’s general assembly to oversee the contracting and issuing of loans. This formalized the issuance of credit, and established fixed locations where investors could purchase shares.

It was around the time that the system of loans became known as the Compere di San Giorgio—the contracts of Saint George—after the saint in whose name they were raised. Once formalized, credit flowed so easily that investors began to worry about the security of their loans. Regulatory articles were drawn up and commissioners were appointed to oversee the operation of the bank and approve all loans.

The compere were issued in a system more formal and sophisticated than almost anywhere else in the world at the time. But reasons of state, not finance, dictated the next stage in the bank’s evolution.

Loss of Supremacy

The rivalry with Venice that had driven so much of Genoa’s early growth precipitated the crisis. Over 125 years, from 1256 to 1381, Genoa fought five wars with that other mercantile republic. These were fought mostly in the Eastern Mediterranean, where trade with the Crusader States, Byzantium, and Genoa’s Black Sea colonies brought the two sides into conflict.

Genoese fortunes ebbed and flowed over the course of these wars, during which both Genoa and Venice sought out alliances, raided each others’ colonies, and hunted down enemy ships all across the Mediterranean. The final such war, which lasted from 1377 to 1381, ended in deadlock. The war had been enormously expensive for Genoa. A decline in state revenues corresponding to the loss of trade share meant that public finances were in terrible shape for decades after the war.

The government realized that a change was needed in the system of credit. The final step that birthed the bank was taken in 1407 with the consolidation of all loans. From then on, rather than receive shares in individual loans issued through the bank, investors received shares in the bank itself. A return of seven percent was paid out on this every year.

By this point, the Casa di San Giorgio was a mix between a public bank and a full-fledged merchant bank. Its purpose had expanded beyond providing credit to the Republic of Genoa, now issuing credit to foreigners and private merchants.

A New, Old Ruling Class

The city government depended enormously on the bank. First and foremost were the expenses of war. Although the great clashes with Venice were over, new powers arose to threaten the city’s fortunes. The Kingdom of Aragon was expanding its fleet in the west, and the ascendant Ottomans menaced the east. Throughout the 15th and 16th centuries, the republic was in a constant state of military readiness, which in turn created a huge demand for credit. This naturally gave the Casa di San Giorgio great power. By controlling credit, its governors could indirectly exert control over the government.

The effect was “a republic within a republic,” as Machiavelli put it. The largest shareholders in the bank were from the most prominent noble houses, and already held enormous influence; the bank simply helped them consolidate this power. Laws were passed to ensure that shareholders’ interests were taken care of—ships whose owners were delinquent on loan repayments, for example, were prohibited from even entering Genoa’s harbor.

Conflict and Convergence

In a certain sense, the interests of the city and the bank were truly aligned. Nearly all Genoese depended on maritime trade in one way or another for their livelihood. It was not just the great merchant houses that profited, but also the crews that manned ships, the shipwrights that built them, the stevedores that unloaded them, and countless other laborers, artisans, and officials involved in one capacity or another.

A note of caution should be added, however, lest this be taken to mean that the whole city was united in common purpose. A contemporary observer noted that, where the citizens of Venice accepted a limit to their own wealth in order to make their city rich, the Genoese made themselves immoderately rich as individuals while impoverishing the commonwealth.

It is true that in times of distress the city’s nobility showed itself willing to levy taxes on itself and extend enormous loans to the government. Shipyards turned out warships to fight off threats, and the great houses lent their own galleys to the effort. The great lords were not so fratricidal as to permit foreigners to rule over them. But times of peace were more perilous, as private actors pursued interests contrary to their neighbors. Factional politics were so intense that noble families fortified entire quarters of the city, ready to shut them off whenever civil violence erupted.

The Empire of the Casa di San Giorgio

The perpetually precarious state of public finances meant that creditors needed greater assurance on their loans. The usual way lenders do this is either by paying higher interest rates or by posting collateral. Genoa did both.

As previously noted, Genoese financiers got around usury laws by assigning lenders certain state revenues for the period of the loan. The credit extended by the Casa di San Giorgio grew so large that the government granted them revenues from the republic’s colonial empire. This included the island of Corsica, the Black Sea territories, as well as trade quarters in various Mediterranean cities.

The bank not only received revenues from these holdings, but became responsible for actively managing them. The republic-within-a-republic had such an effective administration that it is hard to imagine any institution in Genoa better suited to run things.

Administrative efficiency could not win wars, however. The expanding Ottoman Empire dislodged the Genoese from their Crimean holdings in 1475, depriving the city of a major source of revenue. The Ottomans concurrently seized ports around the Mediterranean rim one by one over the next hundred years.

As strong a naval power as Genoa was, it could not hold out alone against such an enormous empire. Successfully fighting the Turks meant cooperating with Venice, which they did only reluctantly on occasion. By the middle of the 16th century, both maritime republics were pushed out of the eastern Mediterranean.

Nevertheless, Genoa thrived. The establishment of the Casa di San Giorgio allowed the republic to play a major role in European affairs well after it had reached its territorial peak—indeed, its true glory days were still in the future. As we will see in part three, the “Age of the Genoese” came not during their heroic days as a rising sea power, or even during the height of their mercantile empire, but long after, when they were constricted to a small slice of the Italian Riviera. Their far-reaching financial empire would have influence on nearly every European state, and affect the course of events in history in a significant way. But that will have to wait until the third and final post on Genoa the Superb.

Read more:

Giuseppe Felloni, a retired professor at the University of Genoa and native of that city, has published a history of the Casa di San Giorgio. He has made the bilingual text online for free on his personal website. In it, he discusses twelve crucial financial innovations that were introduced by the bank. He argues that the bank invented much of what we consider essential to modern finance, and that the economic history of Europe essentially needs to be rewritten. The archives of the Casa di San Giorgio were scattered and uncatalogued before Prof. Felloni’s efforts, explaining their absence from existing histories.